You have spent years acquiring and honing your skills as an engineer. You survived the coding interview gauntlet. It’s been a long road but now you are starting to make good money in a career with lots of growth potential. How do you make the most out of it and reach your financial goals? Read on for a simple guide to money for software engineers.

You have spent years acquiring and honing your skills as an engineer. You survived the coding interview gauntlet. It’s been a long road but now you are starting to make good money in a career with lots of growth potential. How do you make the most out of it and reach your financial goals? Read on for a simple guide to money for software engineers.

A career in software engineering or tech can be financially rewarding. But there’s a difference between having a high income and achieving financial goals. There’s even a term for this situation, known as being a HENRY (High Earner Not Rich Yet).

Financial literacy is something that is rarely taught in schools. And most parents don’t talk to their kids about money, either because they lack the skills or because money is often a taboo subject. I started my professional life with zero financial knowledge. But getting educated on a few basics and creating good habits early on can have a massive impact on your financial future.

Disclaimer: I’m not a financial advisor/attorney/CPA. The content below is based on my personal experiences and meant for informational purposes only. Consult with a professional before making important financial decisions.

Spend less than you earn

This sounds so simple, and yet it’s surprisingly common for people to spend everything they make and more (through debt). It’s very easy to think that once you get that raise or promotion you’ll be better off financially. However, this is often not the case due to lifestyle inflation. This means that your expenses increase in tandem with your income.

The tech environment and the corresponding high incomes can fuel a turbocharged version of keeping up with the Joneses. Your neighbor gets a Tesla, your teammate has a fancier house than yours or your boss talks about the private school her kids attend. All of this puts pressure on you to spend more. It’s similar to how doctors can struggle financially even with very high incomes (see Live Like a Resident over at The Whitecoat Investor).

Being aware of these forces is very helpful in becoming more mindful about your money. Start small by setting aside some money each month. Then increase that by 1% every month. Soon you’ll reach a very healthy savings rate without feeling deprived. Think of 10-15% as a minimum, but aim to save 20-25% of your income or even more as it grows.

Fill the right buckets

Great! now you have a money surplus every month. Where should this go? My suggestion is to prioritize in the following order:

- Emergency fund. Here you want to have 6-12 months’ worth of living expenses in cash. With this in place, you’ll be well-positioned to handle financial setbacks, such as losing your job or an unexpected big expense. It’s amazing the peace of mind that comes with having this in place.

- Debt. If you have any high-interest debt (e.g. >7%) such as credit cards, student loans, or car loans, you want to pay those down aggressively. Otherwise, they’ll be a significant drag on your finances.

- Financial goals. The main one here is retirement but can often include other goals such as: buying a house, a college fund for your kids, money to start a business, or to take a sabbatical.

By having an emergency fund and getting rid of debt, you create a solid foundation. Then it’s time to think big and put money towards what you value the most.

Of course, this is all easier said than done. In a way, finances are a lot like dieting: if you just rely on discipline and willpower you are unlikely to succeed. Instead, you need a system.

Automate: CI/CD for your finances

This concept should be very familiar to engineers. What do you do when you want consistent results? You put together scripts and pipelines to automate the processes. The same is true with your finances: it’s like having a CI/CD pipeline for your money.

You may already be doing this for all or some of your expenses, such as having utilities and mortgage/rent payments automatically deducted from your checking account. But it’s even more important to do this for your savings. Waiting till the end of the month and saving whatever is left rarely works. Instead, you want to pay yourself first, meaning that money automatically flows from every paycheck into savings before it hits your checking account.

No matter what bucket you are working on, it can be automated. You can set up automatic extra payments to any debt, or have part of your paycheck go directly into your savings account. If you have a 401(k) at work enroll in the plan and contribute at least enough to get any company match. Since it’s pre-tax money the impact on your take-home pay is reduced. If you don’t have a 401(k), set up an IRA or even a taxable brokerage account.

A good book on automating your finances is I Will Teach You To Be Rich.

Invest

Last but not least, invest your money so that it works for you. This comes into play once you are working on bucket 3 (financial goals). In particular, for long term goals such as retirement, time and compound interest are your friends. This is neatly expressed by Einstein’s famous quote:

Compound interest is the 8th wonder of the world. He who understands it, earns it; he who doesn’t, pays it.

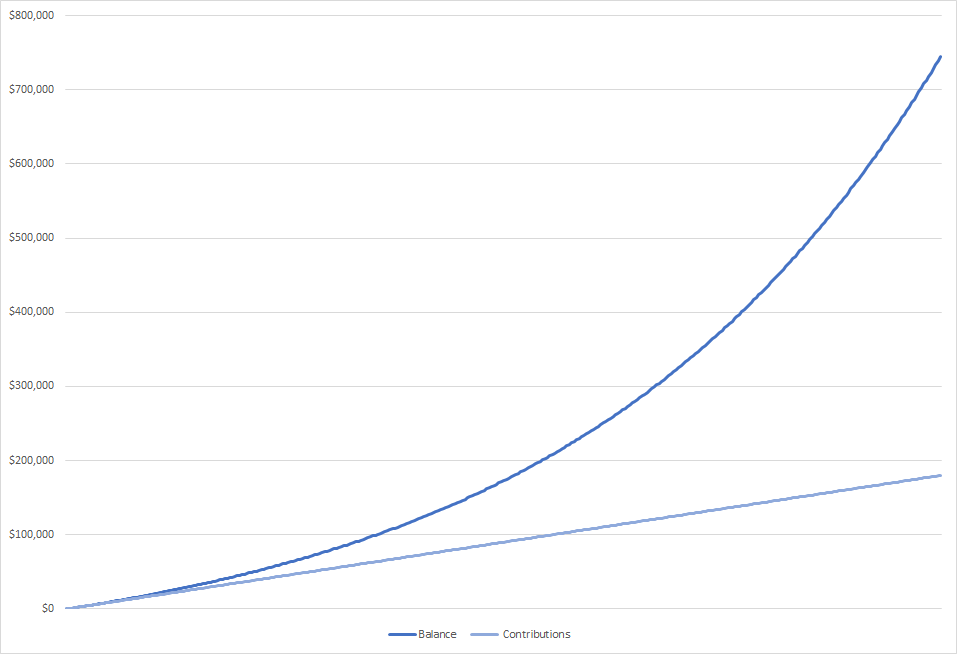

For example, assume you save $500 a month for 30 years and your investments generate an 8% return (a realistic assumption based on historic market returns). You’ll end up with almost $750k after having saved just $180k!. In other words, saving gives you a linear O(n) result while investing makes it an exponential O(1.08n).

A full guide to investing is beyond the scope of this blog. All I’ll say is that it doesn’t have to be complicated. The most important thing to any method is to consistently save money and let it grow for a long time. If you are just getting started I highly recommend reading The Simple Path to Wealth.

I truly believe that good financial habits are an essential part of a successful career. They help you make the most out of your earnings, which translates into tangible benefits for you, your family, or any other causes you want to support. And just as importantly, they put you in a strong position to make career decisions such as changing jobs or taking a break.